May 4th, 2023

Attention spans have diminished rapidly lately as our over-stimulated brains bounce from thing to thing, leaving important information behind—traded for the new shiny thing that perpetually distracts us from the big picture. It currently sits at 8 seconds. 8 Seconds! For the sake of comparison, a goldfish has an attention span of 9 seconds. Yikes. There are devasting effects from this and maybe worth a separate article down the road, but for the purposes of this one we are looking at investing behavior and the stock market.

Our often-mentioned villain the media is also at fault here. The never-ending news cycle keeps us focused on the now and it is easy to lose track of the big picture. It takes discipline to push aside the daily onslaught of news and re-calibrate to the overall trends and/or longer run view. But we believe it is our ticket to a more relaxed, calmer mental state, and very likely, better portfolio returns.

It is true that times are changing, and changing more rapidly it feels. But change isn’t anything new, and neither are terrible things happening in the world. We see more of what we look for, and if everything is pointing to and helping us see bad things, we see and notice more of them. This bias validates the way we feel and think, deepening our position, and the cycle tragically continues on. It is crucial that we recognize and overcome this in order to properly invest.

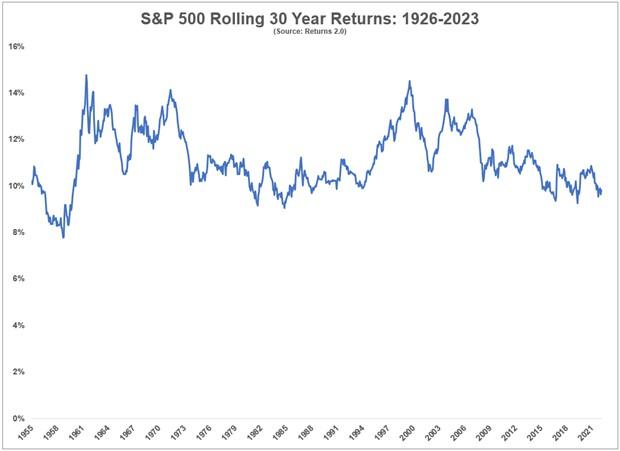

So, lets pull our head up for a moment and examine longer snippets of time in the stock market. If we take rolling 30-year periods and look at the annualized returns in those 30 years, we can see the strength of the equity markets. Going back to 1926, the WORST annualized return over 30 years is 7.8%. Annualized. That would have been investing in 1929 before the Great Depression, losing 80% right out of the gates. If you stayed with it however, even through WWII and other terrible times, you would have experienced 850% growth on your original investment by 1959. This is the worst average annual return in a 30-year period in the last roughly 100 years. The best 30-year annualized number? 14.8% for the period ending in 1968. Nearly twice as good as the worst period.

We know many of you might say, “I don’t have 30 years to wait.” While we hear that, that is missing the point. If you have been in the game a while, then you have years already contributed to these windows of time… so it makes sense to look at these stats and lean on them no matter where you on the spectrum. The recent 10-year annualized gain is 12.7%, the recent 20-year is 10.3%, and the recent 30-year is 9.8%. This 30-year window is relatively ugly as it includes the great recession of 2008, one of only two negative 10 year periods (2000-2010), dot com bubble bursting, 9/11, global pandemic, etc… and yet it yielded 9.8% annualized. Again, not great compared to the average and certainly when compared to the best 30-year window which yielded nearly 15% every year, but still the best game in town for that period.

It's hard to know what is coming at us. And much of what we see isn’t good. But it hasn’t paid off betting against the market over longer periods of time. As we wrote recently, it would be foolish to think the next ten years will look like the last, but with a larger window it does get easier to see trends play out positively, rising above the terrible events and issues that plague us.

Take a step back. Don’t be a goldfish, or worse, don’t be a typical human. Stay glued to your goals. Remember that when it feels bad, it might just be the perfect time going forward. We will never be able to predict short windows of time, and to try is a waste of time and resources. The longer your time frame, the more certain the prediction can be. Another way to say this is the less you focus on what is happening RIGHT NOW, the easier it will be to get what you want out of your portfolios. While being in the now has its benefits, it isn’t a great investment philosophy. Rebalancing and negotiating trends and changes in the market can be helpful, but they are strongly subordinate to the principle of staying with your general allocation (as long as it is based on your goals and plan properly).

Eric & Jeremy