April 19th, 2023

It seems everywhere we turn these days, we read more and more about a looming recession. The challenge is that recessions, and their timing, are difficult to predict. Many times, the economy enters into a recession and bottoms about the same time we learn we are “officially” in a recession. Plus, the stock market typically is 6-9 months ahead of the economy and will typically head higher long before the economic picture looks and feels better. We may be in one of these times as we speak. As you know, we experienced a tough stock market environment in 2022 while the economic and company earnings picture looked pretty good. Conversely, we may be witnessing a slowdown in economic & earnings activity, but the stock market could have seen the bottom already. Or, if we do see it go lower again, we are most likely closer to the end of this correction, rather than at the beginning.

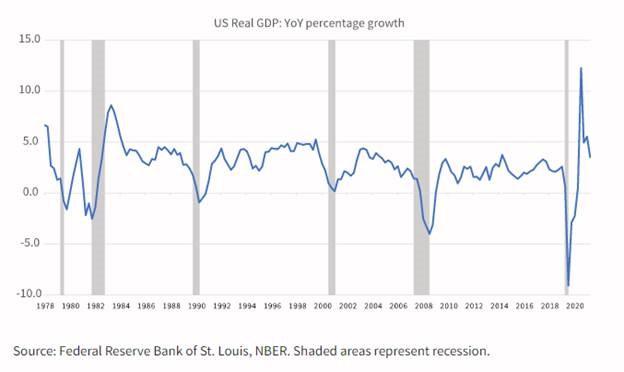

Some of you have seen us cover this chart above, but we wanted to send it to everyone. It shows the year-over-year percentage growth (or contraction) in Real GDP (Gross Domestic Product). The gray bars represent recessions going back to 1978. Many of us remember the pain of the financial crisis of 2008 with the steepest decline in GDP growth since the 1930s…. until 2020. Over almost the last 40 years, even with the financial crisis, you can see the pattern of growth following a contraction (a recession) but the stark difference in 2020 is undeniable and not normal.

We witnessed more than twice the decline in GDP (almost a 10% decline) followed by the steepest recovery on record (almost 13% GDP growth). This cannot be attributed to or blamed on any one political party or leader. It was a consensus decision to shut down the global economy and then pump over 6 trillion dollars into the system. These decisions disrupted any natural economic activity and were anything but normal when looking at history. We are currently most likely paying the price for these decisions with 40-year high inflation.

As for a looming recession, time will tell if and when it arrives, but a couple of observations below:

Sugar high: As the chart shows, it is possible we are currently just coming down off the “sugar high” of super-charged Covid stimulus. Contraction, yes, but contraction off irrational and unsustainable highs.

- Record stimulus: Will the record amount of Covid stimulus still in the system mute the depth of the recession? It’s possible as it was over 6 times what was used during the 2008 financial crisis.

- Low unemployment: Recessions are typically met with higher unemployment but at the moment, the unemployment picture remains historically low and so this could also mute the depth of any recession if more people stay employed.

- Inflation falling: We have seen signs of the growth of inflation slowing but it is still stubbornly higher than the previous decade. It will most likely take a little longer than projected to work its way through the system unless we see a deep recession, which could drive down prices faster.

- FED pivot on interest rates: Unfortunately, the FED has a lot of power, some would say too much power. With the FED raising interest rates at a record pace in 2022, we have begun to see the effects of those higher rates with slowing economic data. There are already projections that the FED will begin lowering interest rates again in 2024, and some project as early as 2023. This isn’t likely unless the economy deteriorates quickly as they still have a primary objective to bring down inflation, which as we said above, most likely will remain stubbornly high for a while longer. History has shown (and we have seen it in the markets in the last few months) that when there is talk of a FED pivot from interest rake hiking, to signaling a pause, to then cutting interest rates, the market has applauded this decision and moves higher.

We are not trying to join the chorus and predict a recession or the timing of it. It does appear that the economy is slowing or as we say above, coming down off the Covid stimulus highs but it’s possible we have seen much of the damage in the markets already. Is it possible we have more pain ahead due to “unprecedented” decisions that were made during Covid? It’s certainly possible and we can try to help navigate that environment if it arrives, but in a future article (be on the lookout soon), when looking at past recessions, much of the negative return shows up well BEFORE the recession starts. In fact, the results are often pretty muted even 6 months before the recession officially arrives.

If you have any questions, please feel free to reach out.

Jeremy